One of the things I love about working in retail technology PR is the chance to develop friendships with so many of the clients, editors and analysts we work with at Ketner Group.

That’s certainly the case with our friends at IHL Group, who helped me learn my way around the retail tech world 20+ years ago.

I recently had the chance to interview IHL analyst Jerry Sheldon about the current state of retail, what’s ahead for the rest of 2022 and why he thinks electric cars could be a disruptive force in retail.

Following are some excerpts from our conversation. Enjoy!

Inflation and recession are the top concerns for the U.S. economy. How is this impacting retail, and what are some of the other headwinds facing retailers in the second half of 2022?

The impact of inflation on consumers is a tale of two cities. If you’re above the median income, your stock portfolio has been hit, but inflation isn’t impacting your day-to-day quality of life.

However, if you’re below the median income, the rising price of gas, food, and other essentials has a significant impact.

In addition to inflation and fears of recession, there are the uncertainties of supply chain challenges, the war in Ukraine, chip shortages and the lockdown in Shanghai due to COVID. As a result, retailers will face a number of headwinds in the coming months.

You’ve expressed concerns about how the lockdowns in China could affect retailers and retail sales for the remainder of the year. Can you elaborate?

As Shanghai reopens, it’s going to take time for manufacturing to get back to normal.

There is a huge backlog of container ships queued up at the port waiting to be loaded, along with pent-up demand to get product to the U.S. In an effort to catch up, shipping levels will be much higher than usual, which will create a logjam at ports of entry.

What happens when all those container ships arrive at in Long Beach? We have rising gas prices, a shortage of long- and short-haul truckers, and limited capacity to unload these container ships.

I’m concerned about the impact of all this on Back-to-School shopping. Schools have re-opened, so there will be a lot more kids returning to the classroom and demand could easily exceed supply.

Inflation will likely continue to be a problem. The food sector has been hit hard with inflation, there’s a massive shortage of cars, and now inflation could spread to the apparel sector.

I hope all this can be rectified before the Holiday shopping season.

IHL has always been a big proponent of unified commerce. Why is it so important for retailers in the post-COVID era?

We published research on unified commerce and optimized customer journeys in January 2020, and then bam! Here came COVID. It’s ironic to see how our findings played out.

During COVID, big box stores had a huge uptick in revenue, and we saw some amazing comps. But if you look at gross margins, they only slightly improved.

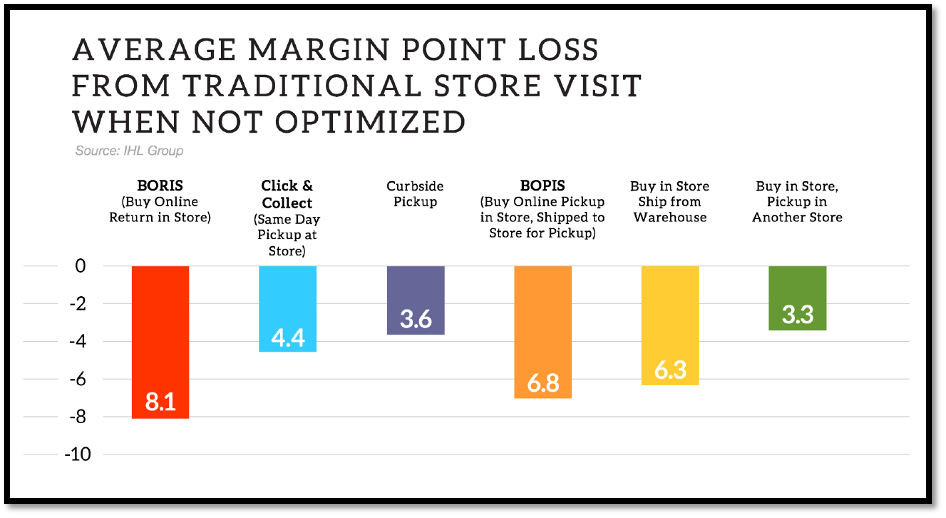

The reason is, you had a big shift in how customers were shopping, and retailers had to support a number of fulfillment models that weren’t profitable. (Note: see chart below). There were significant erosion in profit margins, which creates a big opportunity for technology vendors.

Order management, for example, became very important because retailers had to quickly determine the most profitable way to fulfill an order. Do you fulfill it from your store? Do you fulfill it from your warehouse? How do you ship it?

The importance of mobile devices in retail continues to grow. Can you briefly describe the shift you’re seeing in mobile usage?

Mobile is an interesting example of how retailers are adopting technology. Mobile 1.0 and 2.0 were embraced in particular by smaller retailers that adopted mobile devices as their transaction platforms.

Then with COVID the customer journeys changed, with more curbside, ship from store, etc., and mobility helped support this.

So while we saw a significant shift to mobile POS for SMBs, the really big adoption happened in the enterprise space, helping Tier 1 retailers support the new customer journeys. That’s why we’re calling it Mobile 3.0, which we reference in our report on enterprise mobility.

The past few years have seen significant increases in retail IT spending. As retailers implement new technologies, what are some of the pitfalls to be avoid?

Retailers need to be careful to not overlook security. Every internet or network connected device is a potential entry point for bad actors.

All the IoT devices in stores today are potential entry points into the network, and if they’re not secured properly, it can be problematic. There are potential pitfalls in something as simple as electronic shelf labels.

In our research, we have found that there were a lot of security holes that were opened up as a by-product of bringing devices onto the network in a pretty rapid fashion during COVID.

Looking ahead, what are some of the retail trends you’re thinking about long-term? What’s going to be different 5 years from now?

Electric cars will have a profound impact on retail. Supercharging an electric car takes 30 minutes. How does that affect road trips and where you might stop because of supercharging? How does that affect customer visits and dwell time at gas stations, shopping malls and grocery stores?

How retailers accommodate electric cars could be a big differentiator; this could also give consumers a reason to return to shopping malls. Whereas a gas station can accommodate only a handful of cars, malls could have hundreds of charging stations. Why should consumers queue up at a gas station with limited charging stations when they can go to an air-conditioned mall with numerous restaurants and retailers?

Shopping malls could potentially disintermediate gas stations and provide shoppers with the kind of customer experience that creates long-term loyalty. Electric cars have the potential to impact nearly every retail vertical.